Agile Methodology in Banking

Agile methodology in banking is transforming digital services, with the market expected to grow from $6.8 billion in 2025 to $12.7 billion by 2033. Implementing agile practices like Scrum and Kanban helps banks speed up product development, make faster decisions, and innovate quickly. This rapid adaptation allows financial institutions to respond promptly to market shifts and customer needs.

Key Takeaways

- The agile banking market is growing at 14.30% CAGR, accelerating digital transformation.

- Agile methodologies can speed up product development and decision-making by five times.

- Banks can cut deployment time by 30-50% through continuous integration and delivery practices.

- Cross-functional teams eliminate organizational silos and promote innovation.

- Agile implementation creates operational efficiencies, with 48% of finance teams reporting higher productivity.

Financial institutions adopting agile frameworks gain competitive advantages through quicker release cycles and improved customer experiences. You’ll find these approaches particularly effective for digital banking initiatives where customer feedback shapes development priorities.

The Cultural Shift to Agile

The shift to agile requires cultural change alongside technical adjustments. Teams learn to embrace iterative development and value customer collaboration over rigid planning. This transition supports a more responsive banking environment where customer-centered design drives financial product innovation.

“The agile methodology is reshaping the banking landscape, poised for remarkable growth as institutions embrace rapid innovation and enhanced productivity. By leveraging agile practices, banks can not only accelerate product development but also dramatically improve decision-making, ensuring they remain responsive to the dynamic needs of their customers.”

Agile Methodology in Banking: Market Growth and Business Case

The agile methodology in banking market is experiencing explosive growth, valued at $6.8 billion in 2025 and projected to reach $12.7 billion by 2033. This remarkable expansion is driven by a CAGR of 14.30% (2025-2033) with year-on-year growth of 12.80%. Your bank can leverage agile methodology in banking to stay competitive as digital transformation, evolving customer preferences, and innovation investments fuel this trend.

Banks that implement agile methodologies like Scrum and Kanban adapt faster to market changes and gain significant advantages. According to McKinsey, agile can increase your product development speed and decision-making processes by five times, creating a compelling business case for adoption.

Agile implementation in banking typically involves five key components:

- Agile Coaching

- Agile Software Development

- Agile Framework Implementation

- Agile Project Management

- Scrum Implementation

DevOps integration forms a crucial part of this strategy, reducing deployment time by 30-50% through continuous integration and delivery practices. You’ll need to enhance project collaboration to make these approaches work effectively.

The implementation process requires breaking work into short cycles (sprints) that enable rapid adaptation through feedback loops. Many banks use the following tools:

| Agile Tool | Primary Use | Key Benefits |

|---|---|---|

| Scrum | Daily standups, sprint planning | Enhanced visibility, faster decisions |

| Kanban | Workflow visualization | Process optimization, reduced bottlenecks |

| SAFe Framework | Enterprise scaling | Coordinated delivery across large organizations |

Real-world success stories demonstrate agile methodology in banking’s effectiveness. One bank scaled from pilot teams to over 250 active agile teams, while BBVA Compass now produces 60% of its software via agile approaches, significantly reducing development time.

Operational Efficiency and Innovation

Agile methodology in banking drives operational improvements despite regulatory challenges. About 48% of finance teams report increased efficiencies from AI-agile tools integration, with 40% achieving faster insights and 38% seeing improved accuracy. Additionally, 22% reduce costs while 24% uncover new revenue opportunities.

You can track progress using performance indicators like mean time to recovery/market and flow efficiency. While aging IT infrastructure remains the biggest hindrance according to executives, agile continuous improvement practices help overcome these challenges.

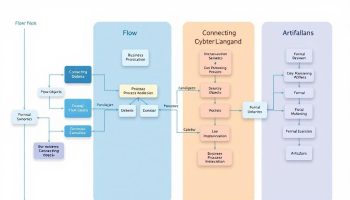

Agile breaks down silos by empowering self-organizing, cross-functional teams that bring together IT, operations, marketing, and compliance. This approach fosters innovation through higher employee engagement, clear roles, and visible progress via dashboards. Your bank can implement embedded payments, AI-driven insights, and ecosystem platforms to effectively compete with fintech disruptors.

Core Components and Implementation Strategies

The banking sector is rapidly embracing agile methodology in banking to stay competitive and innovative. With the Agile Transformation in Banking market projected to reach $12.7 billion by 2033 from $6.8 billion in 2025, you’ll need to understand the core components to implement this approach effectively.

Agile methodologies in banking consist of five key types: Agile Coaching, Agile Software Development, Agile Framework Implementation, Agile Project Management, and Scrum Implementation. Your bank can benefit from adopting agile practices by breaking work into short cycles called sprints, typically lasting 1-4 weeks, which enables rapid adaptation through continuous feedback loops.

Implementing Scrum within your banking environment involves daily standups, sprint planning, and sprint reviews. You’ll see significant improvements when integrating DevOps practices, which can reduce deployment time by 30-50% through continuous integration and delivery pipelines. For enterprise-wide implementation, consider scaling frameworks like SAFe to coordinate multiple agile teams.

Key Implementation Strategies for Banking

To successfully implement agile methodology in banking, you should:

- Start with pilot teams before expanding across the organization

- Invest in appropriate agile tools and technologies

- Establish clear metrics to measure agile performance

- Provide comprehensive training for team members

- Create an agile governance structure that aligns with banking regulations

Real-world success stories demonstrate agile’s effectiveness in banking. One major bank scaled from pilot teams to over 250 active agile teams, while BBVA Compass now produces 60% of its software through agile methods, significantly reducing development time. These examples show how managing project constraints becomes more effective with agile approaches.

You’ll find that agile methodology in banking provides remarkable adaptability to market changes. McKinsey reports that agile can increase product development speed and decision-making by five times, allowing your bank to respond quickly to evolving customer expectations.

The integration of agile methodology with AI tools has delivered impressive results, with 48% of finance teams reporting increased efficiencies, 40% achieving faster insights, and 38% seeing improved accuracy. When properly implemented, agile methodologies enable you to streamline operations while maintaining the necessary regulatory compliance through integrated checks during regular retrospectives.

For optimal results, focus on breaking down organizational silos by creating cross-functional teams that include IT, operations, marketing, and compliance. This approach will foster innovation and improve employee engagement through clearly defined roles and visible progress tracking using agile dashboards and effective project communication.

Agile can increase product development speed and decision-making by five times, allowing organizations to respond quickly to evolving customer expectations.

mckinsey.com

Enhancing Operational Efficiency Despite Regulatory Challenges

The integration of agile methodology in banking has delivered measurable operational efficiency gains. A striking 48% of finance teams report increased efficiencies when combining AI with agile tools. The benefits extend further with 40% achieving faster insights, 38% experiencing improved accuracy, 22% reducing costs, and 24% uncovering new revenue opportunities.

You’ll find that agile approaches help streamline banking operations while maintaining regulatory compliance. By integrating continuous improvement principles, banks conduct regulatory checks during regular sprint retrospectives rather than at project end. This proactive approach identifies potential compliance issues early, reducing costly late-stage fixes.

Banking institutions measure agile success through several key performance indicators:

- Mean time to recovery (how quickly issues are resolved)

- Mean time to market (speed of new feature deployment)

- Flow efficiency (minimizing work bottlenecks)

- Cycle time (total time from request to delivery)

Overcoming Implementation Challenges

Despite its benefits, implementing agile methodology in banking faces significant obstacles. Aging IT infrastructure remains the biggest hindrance according to banking executives. Legacy systems often resist integration with modern agile tools and practices.

You’ll need to carefully evaluate where agile works best in your banking operations. While ideal for product development and customer experience initiatives, agile methodology in banking isn’t always suitable for fixed-scope regulatory mandates with non-negotiable requirements. However, even in regulatory projects, agile can help identify risks earlier and adapt to changing interpretations of requirements.

The regulatory environment presents unique challenges that require thoughtful adaptation of standard agile practices:

- Incorporating compliance checkpoints within sprint cycles

- Maintaining documentation for auditors while staying agile

- Balancing iterative development with fixed regulatory deadlines

- Creating specialized roles for regulatory expertise within agile teams

Banks that successfully implement agile methodology can respond more quickly to market changes while maintaining regulatory compliance. By improving cross-functional collaboration, you’ll break down traditional banking silos that often slow innovation and create inconsistent customer experiences.

Breaking Down Silos and Fostering Innovation

Agile methodology in banking breaks down traditional departmental barriers by creating cross-functional teams that combine expertise from IT, operations, marketing, and compliance. You’ll see immediate benefits through improved communication and collaboration when staff from different specializations work together on specific banking initiatives. This cross-pollination of ideas creates a fertile environment for innovation while ensuring regulatory compliance is built into solutions from the start.

Building High-Performing Banking Teams

Self-organizing teams are at the heart of agile methodology in banking. When you empower your banking professionals to make decisions at the team level, you’ll experience faster execution and greater employee satisfaction. Teams using agile workflow processes report higher engagement levels because:

- Clear role definition creates accountability without micromanagement

- Visual progress tracking through dashboards builds momentum and celebrates wins

- Regular sprint reviews demonstrate value creation to stakeholders

- Cross-departmental collaboration eliminates knowledge gaps between business units

- Shorter feedback loops enable quicker course corrections when needed

The banking sector has traditionally operated in functional silos, but agile methodology in banking challenges this outdated approach. By implementing project collaboration techniques, banks can develop innovative solutions that would be impossible in siloed environments.

This collaborative approach enables banks to compete effectively with fintech disruptors by rapidly developing and deploying new capabilities like embedded payments, AI-driven customer insights, and integrated ecosystem platforms. You can reduce your time-to-market for new banking products while maintaining the necessary risk controls through agile methodology in banking.

| Traditional Banking Approach | Agile Methodology in Banking |

|---|---|

| Department-specific projects | Cross-functional teams solving problems together |

| Quarterly or annual release cycles | Continuous deployment of new features |

| Hierarchical decision-making | Empowered teams with decision authority |

| Siloed information | Shared knowledge and transparency |

| Fixed project plans | Adaptive planning with regular reprioritization |

By implementing agile methodology in banking, your financial institution can foster a culture of innovation while maintaining the stability and security your customers expect. The combination of cross-functional teams, transparent workflows, and iterative development creates an environment where banking innovation thrives.

Organizations that embrace Agile methodologies see 20-30% improvements in employee engagement and productivity, driving both innovation and operational efficiency.

hbr.org