Every business must take risks in order to grow. However, taking risks without controlling them could lead to the demise of an organization. When risk appetite and risk tolerance are compared, risk appetite looks at how much trouble an organization thinks is acceptable. Risk tolerance looks at how much risk an organization thinks is reasonable when it comes to meeting its risk goals.

Likewise, they both say how much risk an entity is ready to take. When a business says that it will not take risks, that could cost it a lot of money. However, when the same company says that it doesn’t want to take risks. It would cause a more than 10% drop in sales from its top ten clients, it defines its risk tolerance.

What does it mean by risk appetite?

Risk appetite frameworks help decision-makers think about the risks and possible exposure. This comes with their chosen strategy or activities when they are making them. A risk appetite framework is set up by the way the organization thinks about the risk-reward connection.

For example, a risk-taking company is ready to deal with more uncertainty and volatility in exchange for the chance of more growth or profit.

In contrast, a risk-averse business places stability above growth or market or operational risk. It may also be affected by regulations or legal rules. Banks and insurance companies, for example, have to stay inside specific regulations. To effectively use a risk appetite framework, a business must agree on measuring and scoring risks. And a standard risk vocabulary that everyone understands and uses.

A risk appetite statement is a written document about how a company thinks about risk. A risk appetite statement is a way for a business to tell both internal and external stakeholders how much trouble it is willing to take. A well-written risk appetite statement helps a business better manage and understand its risks, allowing leaders to make risk-based decisions. In addition, having a comment about how much risk the company is willing to take can help guide the risk or compliance program.

What does “risk tolerance” mean?

On the other hand, risk tolerance sets the ranges of variation. This can happen for a company, business unit, individual project, or a specific risk type. Usually, the group that makes decisions about how to deal with risks sets a range of risk tolerance for the lowest and highest levels of risk, which the organization’s leaders then approve.

After figuring out its risk appetite, a company needs to determine. How much risk it can take and how much it can handle? Risk tolerance is a term that refers to how much trouble a company is ready to take in light of its total risk appetite.

There are many different risks an organization faces, from financial to logistical to credit to third-party to data security to regulatory and legal threats. An organization must weigh these risks and decide how much of each to accept. When talking about risk tolerance, you can say it in many different ways, reflecting the risk’s unique characteristics.

For example, a bank with more risk tolerance might be willing to lend more money to people or businesses with bad credit than a bank with less risk tolerance. This means that the bank is taking on more credit risk. Instead, a company with a global supply chain might be more willing to take risks with foreign exchange or operations. Then, a manufacturer with a domestic supply chain.

Some businesses choose to outsource some of their work, giving up some of their own risks in exchange for the knowledge, value, and flexibility that a third party can bring. Because of their risk tolerance, tactical and organizational goals, and risk appetite. These businesses choose to take on a risk level that fits with them.

The link between risk appetite and risk tolerance:

A company’s risk appetite is set to figure out and manage risks. It looks at the risks of each project and decides how much risk each person is willing to take. Risk tolerance refers to how much risk a business is going to take. In contrast, risk appetite refers to how much risk an organization is ready to take on a larger scale, often shown as a group.

There are two types of risk criteria: qualitative and quantitative. Risk tolerance is all about being prepared to accept risk outcomes. If they happen. Having the resources and control mechanisms to deal with or “tolerate” the risk as stated in these criteria. When it comes to risk-aversion, on the other hand, it is linked to a long-term plan of what must be done and how much money and resources are available to do it.

Take a Risk Posture: What is it?

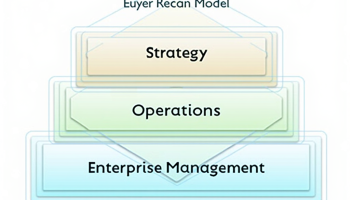

When a company’s risk appetite and risk tolerance are combined, they determine how much risk it can take. This means that the way the company thinks about and deals with risk is fundamental. As a business, it makes decisions about how to spend money, how to pay its employees, and how it runs itself. A substantial risk posture allows businesses to take a lot of risks while still meeting their strategic and operational goals.

To build a strong risk posture, top executives and board support are needed to make sure that accurate risk reporting, assertive risk management, and a coherent method are used. People in the risk department need to set up their own department, use a risk management platform to find and measure risk, and make risk-based decisions.

To say it another way:

To sum up, risk appetite refers to how much risk a company is willing to take while pursuing its goals and before taking any steps to reduce that risk. On the other hand, risk tolerance refers to how much variance there should be around goals.

It’s essential to set a tolerance for each risk because of the reasons above. This tolerance should also be tied to the organization’s/tolerance business’s for the real risk of a change project and then applied to each risk.