Structured Market Entry Process for Sustainable Growth

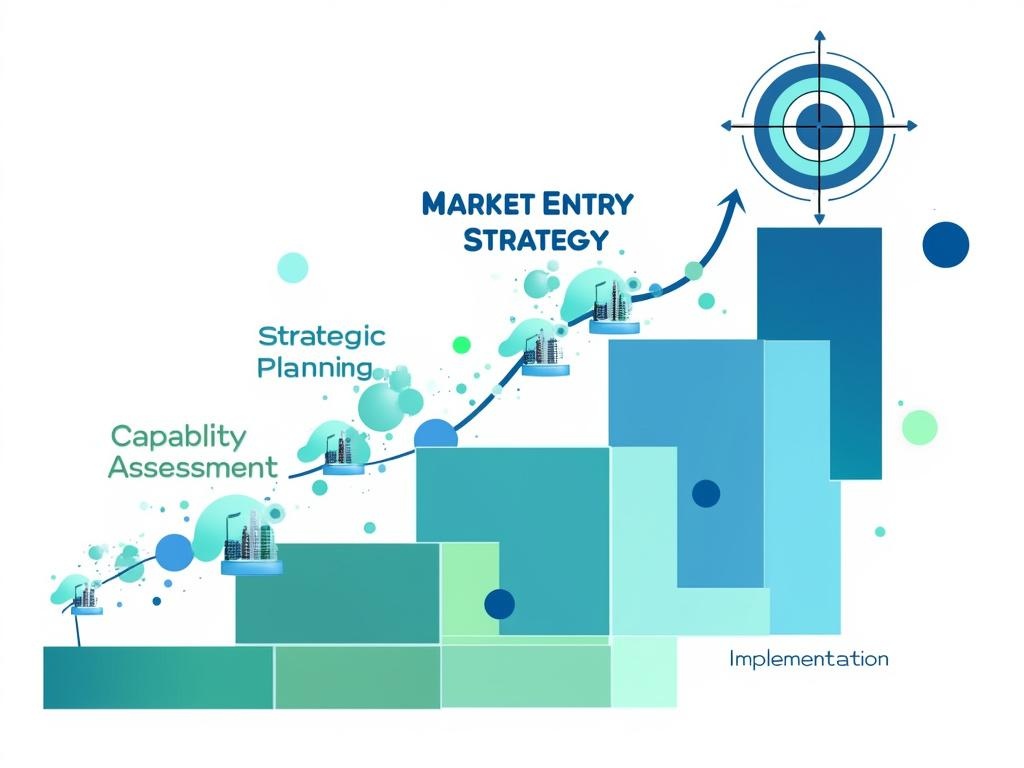

Developing a structured market entry process stands critical for businesses aiming for sustainable growth and expansion into new territories. This comprehensive approach includes thorough research, strategic planning, capability assessment, and methodical implementation to boost success in unfamiliar markets.

Key Takeaways:

- Market entry requires a systematic approach that balances research, strategic planning, and adaptable implementation

- Companies with comprehensive market entry processes experience up to 31% higher success rates

- Successful market entry depends on thorough market research, internal capability evaluation, and strategic method selection

- A customized go-to-market strategy is essential for penetrating new markets effectively

- Continuous monitoring and optimization are crucial for long-term market entry success

Entering a new market demands careful preparation and strategic analysis before you commit resources. Your company needs clear objectives and a solid understanding of the target market’s unique characteristics. Without proper planning, even promising opportunities can quickly become costly failures.

The difference between success and failure often comes down to how well you’ve prepared. Market leaders consistently demonstrate that methodical market entry leads to faster profitability and stronger competitive positions.

Your team must balance ambition with realism during this process. Set specific goals for market share, revenue targets, and customer acquisition while staying adaptable to local conditions. This flexibility, combined with thorough market research, forms the foundation of any successful expansion strategy.

“Effective market entry is not just about seizing opportunity; it’s about crafting a meticulous blueprint that harmonizes research, strategy, and adaptability to ensure sustainable growth. Companies that embrace a structured approach see their success rates soar, proving that informed preparation is the key to thriving in new territories.”

Market Entry Landscape

Developing a structured market entry process is critical when you’re expanding into new geographical territories or introducing new products. This strategic approach forms the backbone of sustainable business growth and requires careful planning across multiple phases. The market entry process involves thorough research, capability assessment, strategic planning, and methodical implementation to ensure success in unfamiliar territories.

You’ll need to navigate through several crucial stages when planning your market entry process. Each phase requires dedicated analysis and strategic thinking to maximize your chances of success. The landscape of market entry has evolved significantly with globalization and digital transformation, creating both new opportunities and challenges for businesses seeking expansion.

Companies that implement a comprehensive market entry process experience 31% higher success rates than those using ad-hoc approaches, according to a recent business expansion study. Your market entry process should be tailored to your specific business model, resources, and objectives to achieve optimal results.

Key Elements of Market Entry

The market entry process encompasses several vital components that you must address before launching into a new market:

- Market assessment and research

- Internal capability evaluation

- Entry method selection

- Go-to-market strategy development

- Implementation planning

- Performance monitoring and adaptation

When developing your market entry process, you’ll need to make critical go/no-go decisions at various stages. These decision points help prevent resource wastage on unviable opportunities while ensuring you capitalize on promising markets.

The complexity of your market entry process will vary depending on factors like market maturity, competitive landscape, and regulatory environment. You’ll find that emerging markets typically require more intensive preparation than established ones due to higher uncertainty levels and information gaps.

Your ability to execute a thorough market entry process directly impacts your competitive positioning. Companies with robust stakeholder identification strategies during market entry often secure more favorable partnerships and relationships in new territories.

The market entry process isn’t linear but rather iterative, requiring continuous refinement as new information emerges. You’ll need to maintain flexibility while progressing through each phase, adjusting your strategy based on evolving market conditions and competitive responses.

Companies that implement a comprehensive market entry process experience 31% higher success rates than those using ad-hoc approaches, according to a recent business expansion study.

forbes.com

Market Research and Assessment

Thorough market research forms the foundation of any successful market entry process. You’ll need to evaluate multiple dimensions of your target market before committing resources to expansion. This critical phase helps identify opportunities and potential pitfalls that could impact your entry strategy.

Begin by analyzing market size and growth potential to determine if the opportunity justifies investment. Current market value provides a baseline, while projected growth rates indicate future potential. For example, a market growing at 15% annually presents different opportunities than one growing at 2%.

Next, examine the competitive landscape thoroughly. Identify key players, their market share, strengths, weaknesses, and typical strategies. This analysis helps you identify potential gaps in the market that your business could fill. Understanding competitor pricing, distribution channels, and marketing approaches provides valuable insights for your market entry process.

Regulatory environments vary significantly across markets and can dramatically impact your entry strategy. You’ll need to investigate:

- Local business registration requirements

- Industry-specific regulations

- Taxation structures

- Import/export restrictions

- Intellectual property protections

- Employment laws

Cultural factors profoundly influence consumer behavior and business practices. Before entering a new market, assess:

- Consumer preferences and purchasing patterns

- Business etiquette and negotiation styles

- Communication norms and potential language barriers

- Cultural attitudes toward your product category

- Acceptance of foreign brands

The following table summarizes key market assessment areas and corresponding research methods:

| Assessment Area | Research Methods | Key Metrics |

|---|---|---|

| Market Size | Industry reports, government data | Current value, growth rate |

| Competition | Competitive analysis, mystery shopping | Market share, positioning |

| Regulatory Environment | Legal consultation, industry associations | Compliance requirements |

| Cultural Factors | Focus groups, surveys, ethnographic research | Consumer preferences, cultural compatibility |

| Economic Stability | Economic indicators, political risk analysis | GDP growth, inflation rate |

A comprehensive market entry strategy should include risk assessment. Political instability, economic volatility, or social unrest can significantly impact your success. Evaluate these factors alongside potential market opportunities.

When conducting your research, leverage multiple data sources for a comprehensive view. Industry reports provide valuable market size and growth data, while competitor website analysis tools offer insights into positioning and marketing strategies.

Ultimately, thorough market research reduces uncertainty in the market entry process and increases your chances of success. By understanding market conditions, competitive dynamics, regulatory requirements, and cultural nuances, you’ll develop a more effective and targeted approach to your expansion.

70% of companies fail to leverage market research to inform their business decisions, leading to missed opportunities and increased risk.

forbes.com

Internal Capability Evaluation

Before you dive into a new market, you need to conduct a thorough internal capability evaluation to determine if your organization is truly ready for expansion. This critical step in the market entry process ensures you don’t overextend your resources or enter markets unprepared.

Your internal assessment should examine several key dimensions of organizational readiness. First, evaluate your production capacity to determine if your current infrastructure can handle increased demand. Can you scale manufacturing or service delivery without compromising quality? Second, assess your technical expertise to identify knowledge gaps that might hinder successful entry.

Consider these essential capability assessment parameters:

- Financial investment potential – Calculate available capital for market entry and expected ROI

- Cost competitiveness – Analyze your cost structure compared to local competitors

- Marketing adaptability – Assess ability to customize messaging for new cultural contexts

- Technical capabilities – Evaluate specialized skills needed for the target market

- Supply chain readiness – Determine if logistics can support the new market

You’ll need to conduct a resource allocation review to ensure proper distribution of assets during the market entry process. This helps prevent overstretching in critical operational areas while supporting expansion initiatives.

Strategic Alignment Analysis

Your capability assessment must also examine how well the potential market entry aligns with your overall business strategy. A strategic planning approach ensures that expansion decisions support broader organizational goals rather than creating distractions.

Evaluate how the market entry process fits with your company’s mission and vision. Does this expansion support your core competencies or require developing entirely new capabilities? The more aligned the opportunity is with your existing strengths, the higher likelihood of success.

A thorough go-no-go decision framework can help you systematically evaluate whether to proceed with market entry. This structured approach weighs internal capabilities against market requirements to identify potential gaps requiring attention before moving forward.

Remember that successful market entry requires both strong internal capabilities and effective implementation. Even the most capable organizations can struggle with expansion if they don’t develop a comprehensive market entry process that accounts for both internal strengths and external challenges.

Businesses that assess their internal capabilities before market entry are 70% more likely to achieve long-term success.

hbr.org

Entry Method Selection

Selecting the right entry method stands as a critical component in your market entry process. Your choice will significantly impact how quickly you penetrate the market, the level of control maintained, and the resources required for success.

When evaluating market entry models, you’ll need to consider several options based on your specific business objectives. Each method offers distinct advantages depending on your risk appetite and desired market presence:

- Exporting – Requires minimal investment while allowing you to test market receptiveness before deeper commitment.

- Licensing – Enables rapid expansion by leveraging local partners’ expertise without significant capital investment.

- Franchising – Provides brand consistency while transferring operational responsibility to local entrepreneurs.

- Joint ventures – Combines your expertise with local knowledge while sharing investment risk.

- Direct investment – Offers maximum control but demands substantial resources and commitment.

The market entry process involves careful consideration of these selection criteria when choosing your approach:

- Risk tolerance – How much uncertainty can your organization withstand?

- Investment capacity – What financial resources can you allocate to this expansion?

- Desired market control – How much influence do you need over operations, branding, and customer experience?

- Speed to market – How quickly must you establish presence to capture opportunity?

Your industry specifics will also influence this decision. For example, technology companies might prefer licensing to protect intellectual property, while retail businesses often pursue franchising for rapid scaling.

| Entry Method | Risk Level | Investment Required | Control Level | Speed to Market |

|---|---|---|---|---|

| Exporting | Low | Low | Low | Fast |

| Licensing | Low-Medium | Low-Medium | Medium | Fast |

| Franchising | Medium | Medium | Medium-High | Medium-Fast |

| Joint Venture | Medium-High | Medium-High | Shared | Medium |

| Direct Investment | High | High | High | Slow |

When implementing your chosen market entry strategy, you’ll need to develop detailed operational plans that include market-specific adaptations. Your approach should incorporate risk response strategies to address potential challenges and ensure successful market penetration.

The market entry process doesn’t end with implementation – continuous assessment helps you refine your approach as market conditions evolve. Establishing clear performance metrics before launch will help you objectively evaluate your progress and make necessary adjustments to your strategy.

Expert Insight: When selecting an entry method for market penetration, carefully align your choice with your organization’s risk tolerance, investment capacity, desired control level, and urgency for speed to market. Options like exporting and licensing can minimize initial investments and quickly test market receptiveness, while franchising and joint ventures balance risk with local expertise. Ultimately, continuous evaluation post-entry ensures adaptability to market changes and drives long-term success.

Go-to-Market Strategy Development

Developing a comprehensive go-to-market (GTM) strategy forms a critical component of your market entry process. This phase transforms your market analysis and capability assessment into actionable plans that drive successful penetration into new territories or segments.

Your GTM strategy needs to address multiple dimensions simultaneously while maintaining coherence with your overall business objectives. Start by creating localized marketing approaches that respect cultural nuances while communicating your value proposition effectively. The market entry process demands careful adaptation of your messaging to resonate with new customer segments.

You should develop pricing strategies that balance competitive positioning with profitability goals. Consider these essential elements for your GTM planning:

- Distribution channel selection aligned with target customer preferences

- Pricing models adapted to local market conditions and competitive landscape

- Promotional activities tailored to regional media consumption habits

- Sales force deployment and training to address market-specific needs

- Customer service frameworks designed for new market expectations

Effective implementation requires strategic planning and execution that incorporates performance measurement frameworks from day one. These frameworks help you track progress and make necessary adjustments throughout the market entry process.

Create clear metrics to evaluate your market penetration success:

| Metric Type | Examples | Measurement Frequency |

|---|---|---|

| Sales Performance | Revenue growth, market share, customer acquisition | Monthly |

| Marketing Effectiveness | Lead generation, conversion rates, brand awareness | Weekly/Monthly |

| Operational Efficiency | Fulfillment times, service levels, cost metrics | Weekly |

| Customer Satisfaction | NPS scores, retention rates, feedback analysis | Monthly/Quarterly |

Your GTM strategy should include contingency planning for different market responses. The market entry process rarely proceeds exactly as planned, so building adaptability into your approach is essential. Risk response strategies help you navigate unexpected challenges while maintaining momentum.

Remember that successful market entry requires balancing standardization with localization. While maintaining core brand values and operational efficiency, you need flexibility to address market-specific needs. This balanced approach helps you achieve faster market acceptance while controlling costs during the expansion process.

Strategic Implementation and Continuous Optimization

After developing your market entry process and launching into new territory, your focus must shift to implementation excellence and continuous refinement. This critical phase determines whether your market entry succeeds or falters in the competitive landscape.

Monitoring key performance indicators (KPIs) provides the foundation for your optimization efforts. These metrics should align with your specific market entry objectives and track progress across multiple dimensions of your business. You’ll need to establish dashboards that capture both leading and lagging indicators to gain a comprehensive view of your market entry performance.

The market entry process requires constant adaptation as you gather real-world feedback. Consider implementing these iterative improvement processes:

- Regular market position assessments comparing actual vs. projected performance

- Customer feedback collection mechanisms for product/service refinement

- Competitive intelligence monitoring to identify emerging threats

- Quarterly strategy review sessions with cross-functional teams

- Process efficiency evaluations to reduce operational friction

Market dynamics rarely remain static, particularly in emerging economies or technology sectors. Your risk response strategies should anticipate potential disruptions and prepare contingency plans for various scenarios. This might include regulatory changes, competitive moves, or economic fluctuations that could impact your market entry process.

Successful market entry often requires strategic planning revisions based on ground realities. The table below outlines common adaptation challenges and recommended responses:

| Challenge | Adaptation Response |

|---|---|

| Lower than expected adoption | Refine value proposition or targeting |

| Unexpected competitive response | Adjust positioning or pricing strategy |

| Regulatory complications | Engage local experts or modify offerings |

| Supply chain disruptions | Develop alternative sourcing or logistics |

| Cultural misalignment | Recalibrate messaging and customer experience |

Your risk mitigation framework should balance proactive and reactive approaches. Proactive measures might include scenario planning, building local partnerships, and maintaining financial buffers. Reactive capabilities should focus on rapid response teams that can address emerging issues before they derail your market entry process.

Success metrics for market entry extend beyond simple revenue targets. Consider these multidimensional indicators to evaluate your market entry performance:

- Market share growth trajectory

- Customer acquisition costs compared to lifetime value

- Brand awareness and sentiment metrics

- Operational efficiency measures

- Return on invested capital

- Regulatory compliance effectiveness

The market entry process never truly ends but evolves into ongoing market management. By establishing robust implementation frameworks and continuous optimization loops, you’ll position your business for sustainable growth in new markets while creating adaptable capabilities that serve future expansion efforts.