Strategic Project Portfolio Management

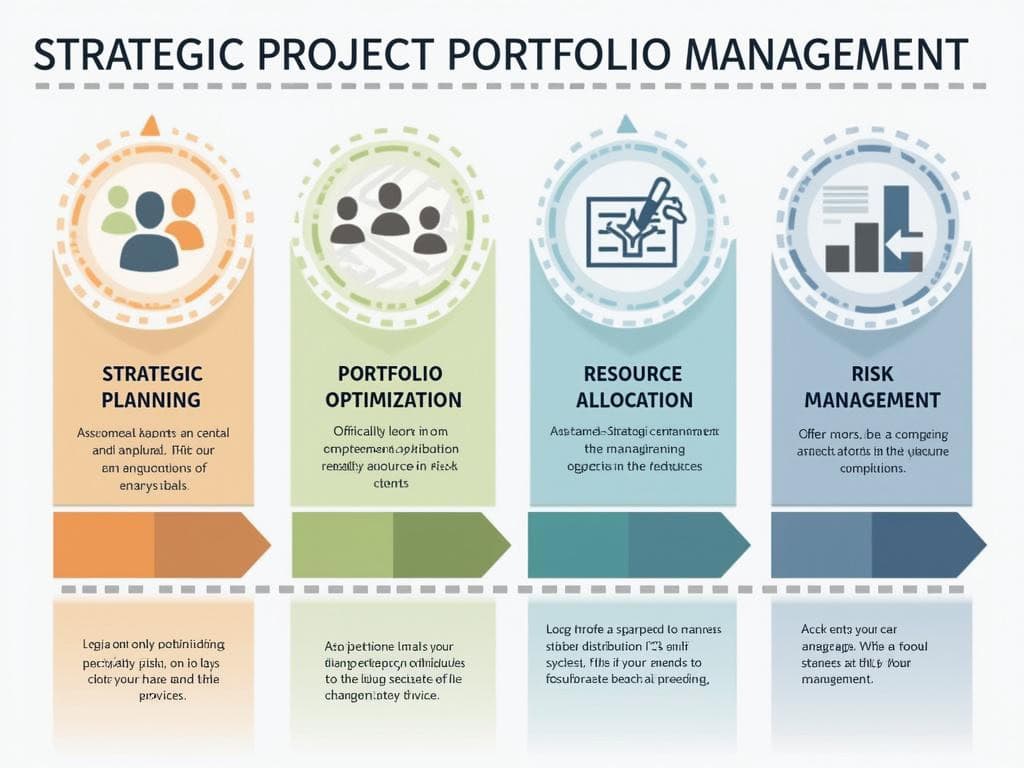

What are the four steps in the project portfolio management process? Strategic project portfolio management consists of four critical steps that align organizational initiatives with strategic objectives. This comprehensive framework includes strategic planning, portfolio optimization, resource allocation, and risk management—all essential for achieving strategic success.

Key Takeaways:

- The first step involves establishing clear organizational objectives and defining project selection criteria that support strategic goals.

- Portfolio optimization requires using weighted scoring models, risk-reward matrices, and cost-benefit analyses to evaluate potential projects.

- Resource allocation demands strategic distribution of limited assets across projects while maintaining organizational capabilities.

- Effective risk management involves aggregate risk analysis, cross-project impact assessments, and centralized risk registers.

- Implementing these four steps can increase project success rates and organizational efficiency by ensuring alignment with strategic priorities.

Strategic Planning

Strategic planning starts with identifying your organization’s core objectives. You’ll need to develop clear selection criteria that reflect these goals, creating a foundation for all future project decisions. This initial step establishes the parameters for what constitutes a worthwhile investment of time and resources.

Portfolio Optimization

During portfolio optimization, you’ll evaluate potential projects using analytical tools such as weighted scoring models and cost-benefit analyses. This systematic approach helps identify initiatives that offer the highest strategic value and return on investment. Many organizations find that using standardized evaluation metrics leads to more consistent decision-making across departments.

Resource Allocation

Resource allocation requires careful planning to distribute finite assets across your project portfolio. This includes assigning appropriate staff, budget, and equipment while maintaining operational capacity. Proper resource management prevents bottlenecks and ensures critical projects receive adequate support without depleting organizational capabilities.

Risk Management

The final step focuses on risk management across your entire portfolio. Creating a centralized risk register allows you to track potential issues that might affect multiple projects simultaneously. Research from the Project Management Institute shows that organizations with mature risk management practices complete 28% more projects successfully than those without such processes.

“Strategic project portfolio management serves as the bridge connecting organizational initiatives to their overarching goals, emphasizing the importance of meticulous alignment and resource optimization. By systematically navigating through planning, selection, allocation, and risk management, organizations can elevate project success rates and drive efficiency in pursuit of strategic excellence.”

Strategic Planning and Portfolio Definition

Strategic planning and portfolio definition form the crucial first stage in the four steps of the project portfolio management process. You need to align all project initiatives with your organization’s strategic objectives to ensure every resource investment delivers maximum value. This foundational step sets the direction for what are the four steps in the project portfolio management process that will transform how you select and manage projects.

Effective strategic planning begins with establishing clear organizational objectives. You can implement frameworks like OKRs (Objectives and Key Results) to define measurable goals that guide your portfolio decisions. This clarity helps identify which potential projects truly support your strategic direction.

When defining your portfolio, you’ll need to:

- Establish governance structures, including a Project Management Office (PMO)

- Create selection criteria that distinguish between operational, strategic, and hybrid initiatives

- Document the portfolio scope and boundaries

- Develop standardized evaluation methods

The governance structure you implement should clearly outline decision-making authority and accountability. A well-structured project sponsor role within this framework ensures executive-level advocacy for strategic initiatives.

Creating Your Portfolio Definition Framework

A comprehensive portfolio definition requires balancing what are the four steps in the project portfolio management process with practical implementation approaches. Your framework should address both selection criteria and governance protocols.

The following table outlines key components to include in your portfolio definition:

| Component | Purpose | Implementation Approach |

|---|---|---|

| Strategic Alignment | Ensure projects support organizational goals | Map each initiative to specific strategic objectives |

| Resource Capacity | Understand available resources | Document current capabilities and limitations |

| Selection Criteria | Establish objective evaluation standards | Define weighted scoring models with stakeholder input |

| Governance Model | Create decision framework | Establish clear roles and RACI model responsibilities |

Your portfolio definition should also include mechanisms for regular strategic review processes to adapt to changing business conditions. What are the four steps in the project portfolio management process must remain flexible enough to accommodate shifts in organizational priorities while maintaining governance discipline.

Expert Insight: When embarking on strategic planning and portfolio definition, prioritize aligning your projects with clear organizational objectives to maximize resource value. Utilize frameworks like OKRs to create measurable goals, which will guide your portfolio decisions and ensure each initiative supports your strategic vision. Establish robust governance structures, including a PMO and defined selection criteria, to foster accountability and facilitate informed decision-making throughout the project portfolio management process.

Portfolio Optimization and Project Selection

Portfolio optimization and project selection form the critical second step in what are the four steps in the project portfolio management process. After establishing your strategic objectives, you’ll need robust methods to evaluate which projects deserve your investment and attention.

Project selection requires both art and science. You’ll need to assess each initiative against established criteria to ensure alignment with your organization’s strategic goals. This evaluation process typically involves analyzing potential projects using quantitative metrics (like ROI, NPV, and payback period) alongside qualitative factors (such as strategic fit and stakeholder support).

To make informed decisions about what are the four steps in the project portfolio management process, consider implementing these proven selection techniques:

- Weighted scoring models that rank projects based on customized criteria important to your organization

- Risk-Reward matrices that visually plot initiatives based on potential returns versus implementation risks

- Growth-Share matrices to categorize projects by market growth rate and relative market share

- Cost-benefit analyses that thoroughly examine financial implications against expected returns

Optimizing Your Selection Process

Successful portfolio optimization requires a systematic approach to prioritization. You’ll need to develop a clear framework that balances your organization’s capacity constraints with strategic objectives. According to strategic planning best practices, this selection process should be transparent and defensible to stakeholders.

When evaluating what are the four steps in the project portfolio management process, remember that effective portfolio optimization isn’t just about picking winning projects—it’s about creating the right mix. You should aim for a balanced portfolio that includes both quick wins and strategic long-term initiatives while managing risk exposure appropriately.

The following table summarizes key considerations during the portfolio optimization phase:

| Selection Factor | Key Questions | Importance |

|---|---|---|

| Strategic Alignment | Does the project support core business objectives? | Critical |

| Resource Requirements | Can we adequately staff and fund this initiative? | High |

| Risk Profile | What are the potential downsides and uncertainties? | High |

| Interdependencies | How does this project affect or depend on other initiatives? | Medium |

| Expected Benefits | What measurable value will this project deliver? | Critical |

By following a structured approach to what are the four steps in the project portfolio management process, you’ll maximize your organization’s return on project investments while maintaining strategic focus.

Organizations that excel in project portfolio management are 38% more likely to meet their strategic objectives.

hbr.org

Resource Allocation and Management

Effective resource allocation stands as a critical component in the project portfolio management process. Understanding what are the four steps in the project portfolio management process helps you optimize resource distribution across multiple projects. When managed correctly, your resources will align with strategic priorities and drive organizational success.

Resource allocation within the PPM framework involves strategically distributing limited assets to maximize value creation. This process requires careful planning and continuous monitoring to ensure projects receive appropriate support without overextending organizational capabilities.

Here are the essential elements for managing resources effectively across your project portfolio:

- Inventory all available resources (human, financial, equipment)

- Match resources to project requirements based on strategic priority

- Establish clear resource allocation processes with approval workflows

- Implement resource leveling techniques to prevent overallocation

- Create contingency plans for resource shortfalls

- Track resource utilization metrics to identify optimization opportunities

Balancing Capacity Constraints

Understanding what are the four steps in the project portfolio management process helps you recognize how resource balancing impacts your portfolio’s success. You’ll need to manage the delicate balance between capacity constraints and project demands to prevent bottlenecks that derail timelines.

This table illustrates common capacity challenges and their management approaches:

| Challenge | Management Approach |

|---|---|

| Resource conflicts | Implement prioritization frameworks based on strategic value |

| Skill shortages | Develop cross-training programs or strategic hiring |

| Unexpected demand spikes | Maintain resource buffers or flexible external resources |

| Underutilization | Reallocate resources to high-priority initiatives |

Real-time tracking of resource utilization becomes essential when implementing your strategic planning initiatives. Modern PPM tools provide visibility into resource allocation patterns, helping you identify imbalances before they impact project timelines. This proactive approach to resource management allows for timely adjustments when priorities shift or unexpected challenges arise.

Reducing conflicts between projects competing for the same resources remains a significant challenge in portfolio management. You can address this by establishing clear escalation paths and project communication channels to resolve resource disputes. Regular portfolio review meetings create opportunities to reassess allocation decisions and ensure alignment with what are the four steps in the project portfolio management process.

Effective resource allocation can increase project success rates by up to 30%, demonstrating the critical importance of aligning resources with strategic objectives.

hbr.org

Risk and Dependency Management

Effective risk and dependency management forms a critical component of what are the four steps in the project portfolio management process. You’ll gain significant advantages by implementing structured approaches to identify and mitigate potential threats across your entire project portfolio.

Project interdependencies create complex relationships that require careful management. When one project affects another, you need to map these connections to prevent cascading issues. By creating dependency networks, you can visualize how delays or changes in one initiative might impact others. This holistic view allows for effective risk response planning that addresses both individual project risks and portfolio-wide concerns.

Portfolio-level risk management differs significantly from project-level approaches. Consider these essential elements:

- Aggregate risk analysis across all projects to identify cumulative exposure

- Cross-project impact assessments to prevent resource conflicts

- Centralized risk registers with severity rankings and mitigation strategies

- Regular risk review sessions with key stakeholders

The implementation of predictive risk analysis techniques provides forward-looking insights about what are the four steps in the project portfolio management process. These methods help you anticipate potential problems before they materialize. By applying simulation models like Monte Carlo analysis, you can quantify the probability of various portfolio outcomes based on identified risks.

Adaptive Strategy Development

Developing adaptive strategies enables your organization to respond effectively to changing business priorities. When market conditions shift, you must reassess what are the four steps in the project portfolio management process to ensure continued alignment with organizational goals. This flexibility allows for quick project issue management and resource reallocation when necessary.

The following table summarizes key risk management approaches across the portfolio lifecycle:

| Portfolio Phase | Risk Management Focus | Key Actions |

|---|---|---|

| Definition | Strategic alignment risks | Validate project selection criteria |

| Balancing | Resource allocation risks | Identify bottlenecks and dependencies |

| Planning | Schedule and budget risks | Develop contingency plans |

| Execution | Performance and quality risks | Monitor KPIs and implement controls |

By integrating these risk management practices throughout what are the four steps in the project portfolio management process, you’ll build resilience into your portfolio. This systematic approach helps maintain strategic direction even when individual projects face challenges. Regular risk assessments ensure that potential threats are identified early and addressed before they can derail your portfolio objectives.

Organizations that excel in risk management can deliver projects that meet objectives 20% more often than their peers.

hbr.org

Implementation and Benefits Realization

Implementing effective project portfolio management directly impacts organizational success through systematic execution of the four key steps in the project portfolio management process. Companies that follow the four steps in the project portfolio management process see a remarkable 35% increase in successful program completions. These four steps ensure your strategic vision transforms into operational reality.

The Four Steps in the Project Portfolio Management Process

The PPM process follows a structured approach that keeps your projects aligned with organizational goals. Here are the four steps in the project portfolio management process that drive success:

- Strategic Planning and Portfolio Definition – You’ll first establish clear organizational objectives and identify potential projects. This step involves mastering strategic planning to ensure all initiatives connect to your core business goals.

- Portfolio Optimization and Project Selection – This critical phase requires evaluating and prioritizing projects using both quantitative and qualitative metrics. You’ll implement scoring models with weighted criteria to make informed decisions about which initiatives deserve your resources.

- Resource Allocation and Management – Once you’ve selected your projects, you must distribute resources efficiently across your portfolio. This step reduces conflicts and bottlenecks while balancing capacity constraints through effective capacity planning.

- Risk and Dependency Management – The final step involves identifying project interdependencies and managing portfolio-wide risks. You’ll develop adaptive strategies for changing business priorities using predictive risk analysis techniques.

Following the four steps in the project portfolio management process delivers tangible benefits including elimination of redundant initiatives, enhanced organizational efficiency, and improved profitability. Modern PPM software supports these efforts by providing real-time dashboards for tracking progress across your entire project landscape.

The implementation phase is where theory meets practice – you’ll see how well your project integration management functions when executing these four steps. Organizations that master the four steps in the project portfolio management process create a competitive advantage through better resource utilization and strategic alignment.

By consistently applying these four steps, you’ll move beyond simply managing projects to strategically advancing your organization’s most critical objectives.